Sage 300

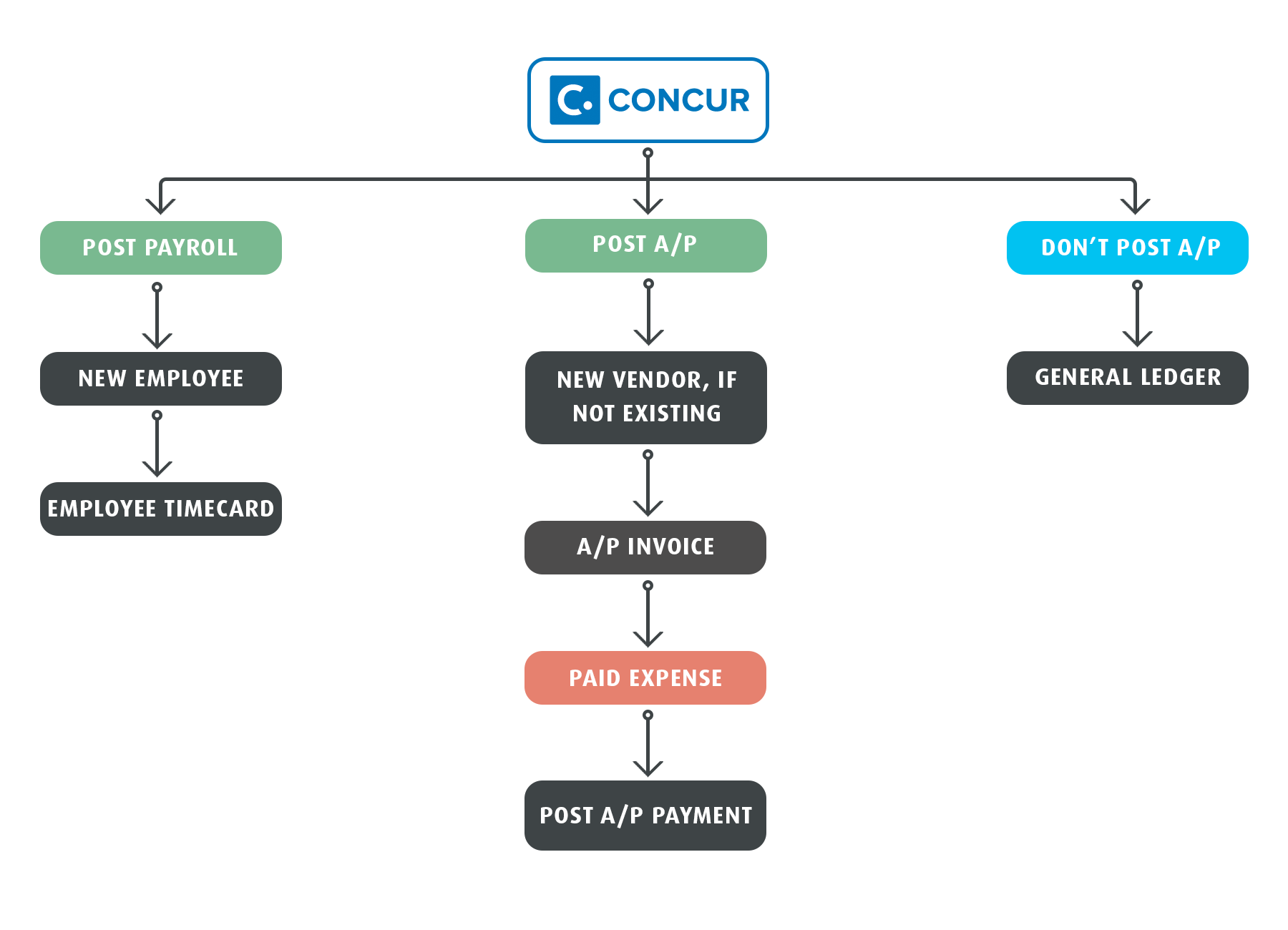

The Sage300 integration provides the ability to post expense entries into different Sage modules allowing you to match your accounting processes.

The method in which expenses are processed is determined through the Bank Code translations, where each payment type can be setup differently.

Post AP

When enabled the expenses will be posted through the Accounts Payable ledger as invoices.

Vendor accounts will be created for each unique/new employee record denoted by its Employee ID Field.

Where an expense is paid (either by the Concur Payment Server, or through a company card, an A/P pre-payment will be created for each expense report and allocated to the invoice.

Both the A/P Invoice and A/P Payment batches will be left open.

Posting to Payroll

When enabled, unpaid expenses will be processed through either US or Canadian payroll modules instead of Accounts Payable; paid expenses conversely will be processed through Accounts Payable.

Posting to General Ledger

When ‘Post Purchase Ledger’ is set to False, expenses will be posted to the General Ledger instead.

All entries will be posted as standard G/L entries, using the G/L offset specified in the Concur setup.